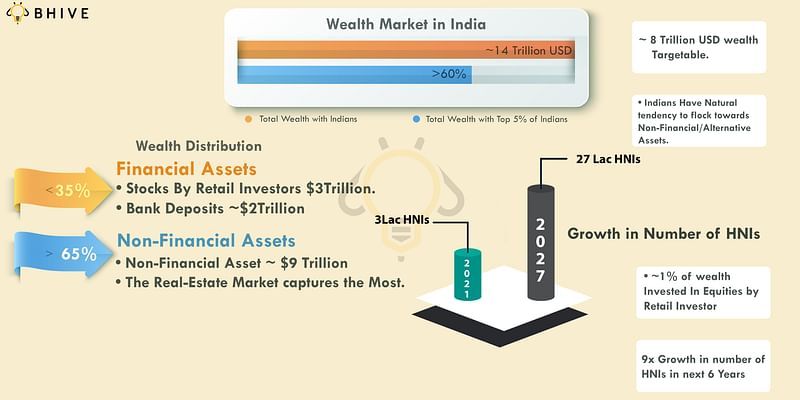

India's average net worth is booming and according to the latest report by Credit Suisse, a majority of India's wealth is held by the top 5 percent of HNI (High Networth Individuals) who own ~62 percent of India's assets. But among the 5 percent, only 0.1 percent is well served. The remaining have tried their hand at Fixed Deposits (FD), equity investments, mutual funds, residential property, etc, but they actually have the appetite to invest beyond these traditional methods. The challenge lies in the lack of accessibility to institutional-quality investment opportunities like Commercial Real Estate (CRE).

While Angel list and LetsVenture do a similar syndication deal that allows HNIs to invest in startups and alternatives, BHIVE is a similar platform, where instead of startups, you get to invest in alternative assets like Commercial Real Estate (CRE), Revenue Based Financing (RBF) and international real estate.

Today, apart from investing through BHIVE’s FinTech platform in opportunities, retail investors can now invest in BHIVE company directly as angel investors. BHIVE has oversubscribed their offering on the LetsVenture platform by around 105 percent in a week and reviews are a testament to how much people love the product and the CRE market in general.

Creating a pool of wealth for HNIs

In the Indian market, bank deposits have a cumulative value of over $2 trillion. Currently, the rates that fixed deposits are offering is just about matching the annual inflation rate. Rental yields from investing in residential apartments have also dropped to ~2.4 percent per annum which is even lower than fixed deposits. Many HNIs are exploring investing in other asset categories such as CRE that offer better monthly income plus long-term appreciation.

"Imagine, even if we’re able to capture 1 percent of this market share, we’re looking at a huge number like $20 billion of assets coming under our management over the next few years," says Shesh Rao Paplikar, Founder, BHIVE.

The need of the hour is a competitive and comprehensive platform that allows HNIs to invest in international real estate, CRE, schools, hospitals and the like. And this is where BHIVE's fintech investment platform bhive.fund comes in.

BHIVE is now in the advanced stages of closing its Pre Series A round. They saw a phenomenal response on the LetsVenture platform and are closing on the round further with a few micro VCs and well-known angel investors.

"In the third straight month of starting full-fledged sales, we hit Rs 7.76 crores of the sales in a single calendar month. This was also possible as we have been able to bring close to Rs 200 crores worth of inventory onto the platform for HNIs to invest. We realised that it’s important for us to raise $1million to $2 million in the company right away to ensure that the growth momentum continues. This money will be deployed in sales, marketing and technology before we kick off the long effort of closing on a larger Series A round. We’re quite thrilled by the response we’ve got so far on our funding round. You can expect some big announcements to come soon,” he says.

Sunitha Ramaswamy, President, Early Stage, LetsVenture says, “BHIVE has been one of the early pioneers in the co-working space and has over the years, showcased a forward-thinking attitude. They've launched BHIVE Fund for HNIs to invest in CRE and other alternative asset classes which gives much better returns compared to traditional investment options. This is indeed a great investment opportunity since a platform like BHIVE Fund helps individuals to become fractional owners as well of the property they invest in. With the team now looking to expand their full-stack services in the real estate sector, we at LetsVenture, are looking forward to working with the team.”

By the end of FY21-22, BHIVE plans to achieve an AUM (Assets Under Management) of Rs 200 crore and by the end of the next financial year, to hit the Rs 1,000 crore mark.

Sourcing the best CRE deals

While BHIVE offers Fractional Real Estate (FRE) and Revenue Based Finance (RBF) in the CRE space, the potential for CRE is immensely high, with the highest being in Bengaluru worth over Rs 20,000 crore.

While globally, the space has already picked up the pace, HNIs, here in India, are missing out on great deals. This gives BHIVE an opportunity to fill the gap by offering them investment opportunities in the deals that they were missing out on before.

"I tell people that they originally came in to be an investor in real estate, but accidentally ended up being a landlord. Who wants to get a call from his tenant in the middle of the night to fix hospitality issues? Like Blackstone, we want to bring deals to our clients that give them high returns. Our goal is to be like the Blackstone for retail investors or HNIs,” says Shesh.

He adds, “Like true investors, they need to analyse the opportunities and decide which ones to invest in and what kind of portfolio they want to build. We have a huge team that understands the nuances of the real estate market and takes the effort of scanning through a lot of properties to source the best deals. We want to ensure people spend more time on analysis of available opportunities than managing the asset, which would be the case if they themselves invested in the asset," says Shesh.

The process is simple. BHIVE acts as the dealmaker and identifies and sources the deal, structures an investable deal, syndicates the deal investments, and also manages the assets.

A niche offering led by experts

While a lot of companies offer RBF and FRE in the CRE space, there's no other platform that offers both, except BHIVE. "We're targeting HNIs who want both these products. We're taking a global outlook but targeting the Indian audience," says Shesh.

What makes BHIVE stand out is the ability to not only strike the right deals, but manage the assets through its sister concern BHIVE workspace, wherever suitable. With 130+ investors on their platform, they are a digital-first company driven by an exceptional team of founders who bring a wealth of real estate, technology and investments knowledge to the table.

“At the end of the day, what we’re building here boils down to the quality of the team in our arsenal. The comprehensive set of offerings and the credentials of the team makes the business less imitable, thus setting the barriers to market entry higher. While many are trying to do FRE, building a wealth creation platform like www.bhive.fund is extremely difficult. Hardly anybody has the kind of experience and skills the founders here have got in CRE, deal-making and leasing,” says Shesh.

He further explains, “BHIVE’s finance team is in a different league with the kind of talent we’ve been able to bring on board. Our app that is already released is already ahead of most of what others have been trying to do. Also, on a global level, we’re one of the few who have the ability to build something that goes well beyond just being FRE listing platform and to be a true wealth creation platform with multiple types of offerings, the ability to manage the assets and thereby manage the risk for investors.”

Prior to coming back to India in 2014, Shesh worked in Wall Street. He has strong experience in technology in the financial domain. Since 2014, he has been an integral part of the Bangalore startup ecosystem and has also worked closely in the Bangalore Commercial Real Estate world over the years. Shesh and Co-founder Monnappa were both classmates at the National Institute of Technology Karnataka (NITK), where they both studied Computers Engineering.

Sandeep Gupta, headed MB Invest at Magicbricks and also founded a blockchain tech startup, before joining BHIVE. In his corporate career spanning two decades, Sandeep has worked with Britannia Industries, Bombay Burmah, New Chennai Township, Cinépolis, and GMR. He holds a certificate in investment performance measurement. Sandeep is an IIM Ahmedabad (IIMA) alumnus and a CFA charter holder.

An alumnus of NITK and IIMA, Monnappa Bayavanda, before joining BHIVE, was part of the Amazon India founding team and prior to that, he was a solutions architect in i2 technologies (later JDA software and Blue Yonder).

Future outlook through the tech lens

BHIVE is on a strong growth path and is transforming the world of real estate by looking outside the regular ways of investing. In the future, they plan to diversify more into FRE and the wealth management category, and penetrate the international CRE market.

To manage the large influx of investors in CRE, technology is the only way. The bhive.fund app is available on the Google Play Store, where highly lucrative deals are made available to avid general investors. There are videos for each asset class, everyone gets a passbook, they can access investment memos and wealth analysis reports. The app will be made available on the Apple app store by the end of January 2022.

"Indians are the second biggest savers after China. We don't have the wealth mindset and don't put our money into opportunities where it can turn into wealth. We save money instead and spend it later. At BHIVE, we want to change that narrative," says Shesh.

If you have any further queries with regard to the investment, you can reach out to Ceooffice@bhiveworkspace.com.

No comments:

Post a Comment