Ever since its listing on July 23 last year, the share price of foodtech decacorn never went under the three-digit figure.

On BSE, the stock touched a low point of Rs 112.55 apiece, on Friday, January 21, and that did not seem abnormal given the volatility that Indian equity markets have witnessed in recent weeks.

For the record, just five trading days ago, on January 18, the Sensex had touched 61,475.15 points – its highest in 2022. In comparison, at Monday's low of 56,984.01 points, the 30-stock index was down by a whopping 4,491.14 points – or 7.31 percent.

In the Monday mayhem, the Sensex lost 2,053.17 – or nearly 3.5 percent – to touch the day’s low, compared to Friday’s close of 59,037.18. At the end of the day’s trade, the benchmark index shredded 1,545.67 points – or 2.62 percent – to close at 57,491.51 points.

And Zomato was anything but an exception in the volatile correction of Monday. On the 127th trading day since its listing, Zomato breached the psychological three-digit barrier, and fell to Rs 91 apiece.

Apart from touching its lowest point since listing, the 20 percent single-day fall triggered the lower circuit on the stock.

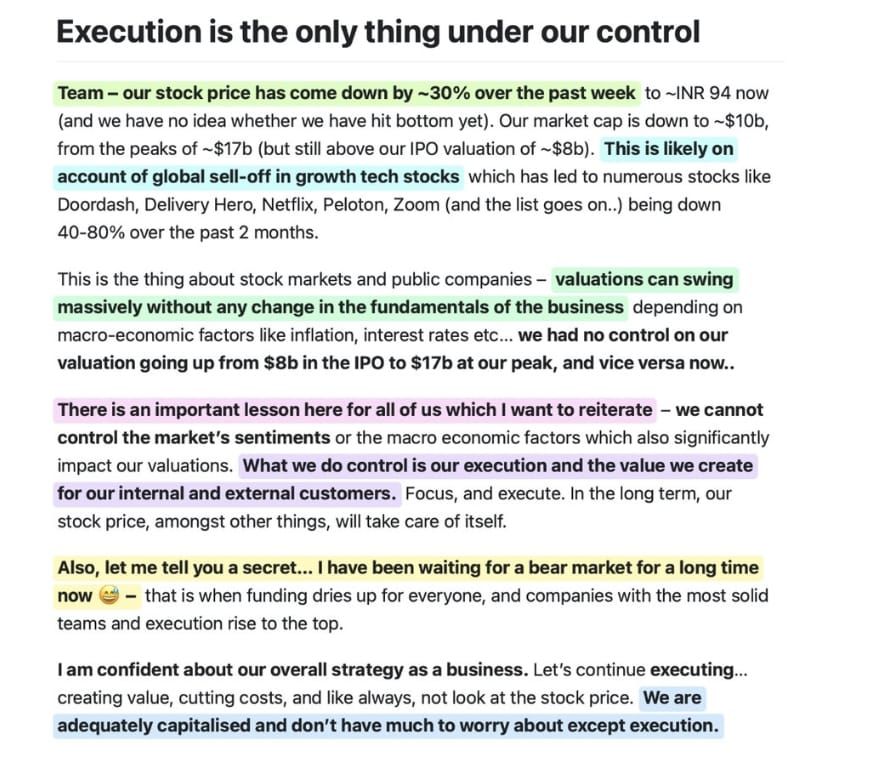

After market-hours, a note addressed to Zomato employees from Deepinder Goyal, Zomato’s Founder and CEO, started making rounds among market circles, as well as on social media.

If one wonders why a CEO of a recently-listed tech startup wrote to his employees on a choppy day in the stock market, there are three reasons behind it.

One; Zomato has got accustomed to stock price movements – both downward and upwards – but not a steep fall breaching the three-digit mark.

Two; open communication makes startups stand out as compared to larger corporations, and Deepinder personified this belief.

Three; according to Zomato's shareholding pattern for the quarter ended December 2021, Zomato’s Employee Benefit Trust holds over 233.39 million shares, which works out to be 2.97 percent of Zomato.

Compared to Deepinder’s 4.69 percent shareholding through 369.4 million shares, the employee benefit trust’s holding is a little over 63 percent of Deepinder’s personal stake in Zomato.

“Employees are the very crucial assets in technology-run businesses, and communicating with them during a crisis takes the trust in management to another level,” says the chief executive of a boutique wealth management outfit in Mumbai.

Coming back to Deepinder’s note, he started with the mention of Zomato’s stock price coming down by nearly 30 percent over the past week to Rs 94. Going by the timestamp of Zomato’s price movement on BSE, the time of price reference is expected to be after 9:55 AM, post which the stock fell below Rs 100 apiece.

“We have no idea whether we have hit the bottom yet,” Deepinder wrote. Clearly, he would not have imagined that the stock was going to hit its 20 percent lower circuit as the trading day was approaching its close.

Deepinder added that Zomato’s market capitalisation is down by nearly $10 billion, from the peak of nearly $17 billion. “But still above our IPO valuation of close to $8 billion,” he wrote.

“This is likely on account of global sell-off in growth tech stocks which has led to numerous stocks like Doordash, Delivery Hero, Netflix, Peloton, Zoom (and the list goes on...) being down 40-80 percent over the past 2 months,” Deepinder added.

“Valuations can swing massively without any change in the fundamentals of the business depending on macro-economic factors like inflation, interest rates,” he further noted. “We had no control on our valuation going up from $8 billion in the IPO to $17 billion at our peak, and vice versa now.”

For the record, at $9.67 billion on Monday, Zomato’s market capitalisation fell by $7.2 billion – or 42.7 percent – from $16.88 billion on November 25 last year. That’s near -43 percent correction in a matter of 43 trading days.

In his note, Deepinder added that there is an important lesson here for all of them, which he wanted to reiterate. “We cannot control the market’s sentiments or the macro-economic factors which also significantly impact our valuations,” he wrote.

“What we do control is our execution and the value we create for our internal and external customers. Focus, and execute, in the long term, our stock price, amongst other things, will take care of itself,” Deepinder added.

He went on to reveal a secret in his note. “I have been waiting for the bear market for a long time now – that is when funding dries up for everyone, and companies with the most solid teams and execution rise to the top.”

However, the timing of Deepinder revealing his secret love for bear markets – which causes drying up of funding – and Zomato hitting its lower circuit turned out to be an irony of sorts.

This is because on the same day, Zomato’s arch-rival – — revealed that it had raised $700 million at a decacorn valuation of $10.7 billion – up from its previous valuation of $5.5 billion some six months ago.

Deepinder, towards the end of his note, spelt out that he is confident about Zomato’s overall strategy as a business. “Let’s continue executing… creating value, cutting costs, and like always, not look at the stock price,” he noted. “We are adequately capitalised and don’t have much to worry about except execution.”

Edited by Kanishk Singh

ليست هناك تعليقات:

إرسال تعليق